The financial sector of the Central African Economic and Monetary Community (CEMAC) is experiencing a boom, thanks to bold reforms carried out with the support of the African Development Bank Group.

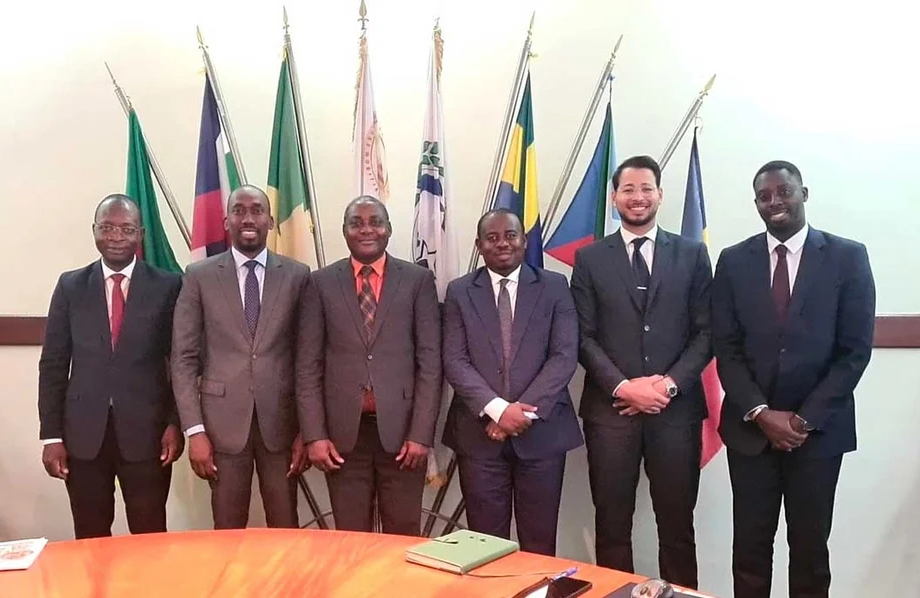

An African Development Bank mission visited Douala and Yaoundé from 25 to 29 April to assess the status of reforms in the CEMAC financial sector, their overall strategic direction, progress and results achieved to date. CEMAC comprises six Central African countries (Cameroon, Central African Republic, the Republic of Congo, Gabon, Equatorial Guinea and Chad).

The mission focused on three projects. These are: the Support Project for the Start-up of the Central African Unified Financial Market, the Support Project for the Central African Unified Financial Market, and the Support Project for the Deepening of the CEMAC Financial Sector. These three technical assistance projects, totaling $5.722 million, aim to support the deepening and broadening of the region’s financial markets.

Thanks to the reforms undertaken, the CEMAC financial market has undergone a transformation since 2019. The money market, an almost non-existent segment of the regional financial market in 2018, recorded strong growth in interbank transactions, which reached 288 billion CFA francs in August 2021 against 153 billion CFA francs in August 2020, an increase of 88%. On the securities market, outstanding CEMAC treasuries reached 5820 billion CFA francs on 31 March 2022 versus 1000 billion CFA francs in 2018, when the reforms were launched, representing an increase of 482% in three years. The securities market increased from 2.1% of gross domestic product (GDP) in 2018 to 8% in March 2022.

The number of securities listed on the Central African Stock Exchange increased to 18 on 31 January 2022 from 15 a year earlier. The number of bonds increased from 11 on 31 January 2021 to 13 on 31 January 2022, an increase of 18.18%. The number of stocks increased from four at 31 January 2021 to five in January 2022, with the market capitalization growing from 140.90 billion CFA francs to 159.08 billion CFA francs, an increase of 12.90%.

“This development is not only the concrete result of the reforms undertaken, but it also attests to the willingness of CEMAC economic actors to increasingly use the financial market to finance their activities,” said Serge N’Guessan, Director General of the African Development Bank Group for Central Africa.

The Bank intends to continue its support in this sector and remains committed to the economic actors of the